Comprehensive Guide to CUK Stock: Insights and Opportunities

Introduction

CUK stock, representing Carnival Corporation & plc, has become a topic of interest for investors seeking opportunities in the leisure and travel sector. As the world begins to recover from global disruptions, the performance of CUK stock offers insights into the rebounding travel industry. This blog post will delve into the nuances of CUK stock, analyzing its historical performance, current trends, and future prospects.

CUK Stock

CUK stock represents a dual-listed company structure, comprising Carnival Corporation (USA) and Carnival plc (UK). This unique structure allows investors to engage with the global cruise market through a single entity. Understanding the nature of CUK stock is crucial for investors who are considering diversification in the leisure sector.

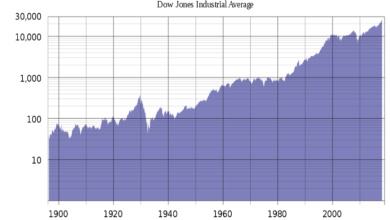

Historical Performance of CUK Stock

Analyzing the historical performance of CUK stock reveals its volatility and resilience. Over the past decade, CUK stock has experienced significant highs and lows, influenced by economic cycles, global events, and sector-specific trends. This section explores these patterns to provide a foundation for understanding its potential future movement.

CUK Stock in the Post-Pandemic World

The post-pandemic recovery phase is crucial for CUK stock as the travel and tourism sector begins to revive. The easing of travel restrictions and increasing consumer confidence could potentially lead to a surge in demand for cruise vacations, directly benefiting CUK stock.

Financial Health of Carnival Corporation & plc

Evaluating the financial health of Carnival Corporation & plc is essential for potential investors of CUK stock. This section breaks down the key financial metrics, including revenue growth, debt levels, and profitability, to assess the company’s stability and growth potential.

CUK Stock and the Cruise Industry Dynamics

The dynamics of the cruise industry play a significant role in the performance of CUK stock. This part of the discussion will focus on industry growth trends, competitive analysis, and the strategic positioning of Carnival Corporation in the marketplace.

Investment Strategies for CUK Stock

Investing in CUK stock requires a strategic approach due to its sector-specific risks and opportunities. This section provides practical investment strategies, including long-term holding, dividend reinvestment, and portfolio diversification tactics.

Risks Associated with CUK Stock

While there are opportunities, CUK stock also comes with risks. Economic downturns, regulatory changes, and environmental factors are just a few of the risks that need consideration. This comprehensive analysis helps investors make informed decisions.

CUK Stock and Environmental, Social, and Governance (ESG) Factors

The impact of Environmental, Social, and Governance (ESG) factors on CUK stock is becoming increasingly significant. This section explores how Carnival Corporation is addressing these issues and what it means for investors.

CUK Stock Price Analysis and Predictions

This technical analysis section looks at CUK stock price movements, chart patterns, and predictive indicators to forecast future price behavior. Whether you’re a seasoned trader or a new investor, understanding these elements is crucial.

How to Buy CUK Stock

For those new to investing, this practical guide explains how to purchase CUK stock, including choosing a brokerage, understanding stock orders, and executing a purchase.

CUK Stock Dividends and Returns

Exploring the dividend history and return rates of CUK stock provides insights into its value as an income-generating investment. This section discusses the stability and sustainability of Carnival Corporation’s dividend payments.

Global Economic Factors Impacting CUK Stock

CUK stock is sensitive to global economic conditions. This section discusses how international economic indicators, such as GDP growth rates and tourism trends, directly impact CUK stock’s performance.

The Future of the Cruise Industry and CUK Stock

Predicting the future of the cruise industry is vital for understanding the long-term potential of CUK stock. This section provides an outlook on industry innovations, consumer trends, and regulatory changes.

Comparing CUK Stock with Competitors

A comparative analysis with major competitors gives a broader market perspective and helps to position CUK stock within the industry. This section covers key players and their strategies, market share, and financial health.

Expert Opinions and Analysts’ Views on CUK Stock

Gathering insights from industry experts and financial analysts can provide a deeper understanding of CUK stock’s potential. This section summarizes recent analyst reports and expert opinions on Carnival Corporation & plc.

Conclusion

CUK stock represents a unique investment opportunity within the recovering travel sector. While it carries certain risks due to its industry-specific challenges, the potential for growth as the global economy stabilizes is significant. Investors considering CUK stock should weigh these factors carefully, stay informed about global economic trends, and align their investment with their risk tolerance and financial goals.

FAQs

Q1: Is CUK stock a good investment for 2024?

A1: CUK stock could be a good investment if the travel and leisure sectors recover as expected. However, investors should consider their risk tolerance and market conditions.

Q2: What are the major risks facing CUK stock?

A2: Major risks include economic downturns, stricter environmental regulations, and potential health crises that could affect travel frequencies.

Q3: How does Carnival Corporation & plc’s dual-listed structure affect CUK stock?

A3: The dual-listed structure allows investors to benefit from a combined market presence, potentially leading to greater liquidity and stability.

Q4: Can I receive dividends from investing in CUK stock?

A4: Yes, Carnival Corporation has historically paid dividends, but the continuity and amount can vary depending on financial performance.

Q5: Where can I buy CUK stock?

A5: CUK stock can be purchased through any brokerage that offers international stock trading capabilities.