Innd Stock Forecast: Unlocking Future Investment Potential

Curious about Innd stock? Want to know its future potential?

The Innd stock forecast is a topic of interest for many investors. Understanding the factors that influence its performance can help you make informed decisions. Whether you are a seasoned investor or just starting, knowing the forecast can provide valuable insights.

This blog post will explore the various aspects of Innd stock. We will look at market trends, expert opinions, and key indicators. By the end, you will have a clearer picture of what to expect. Let’s dive into the world of Innd stock and uncover its potential.

Credit: www.tradingview.com

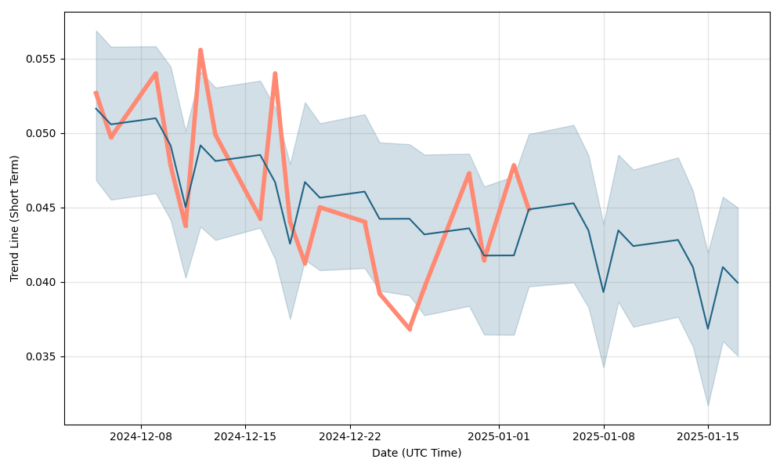

Current Market Analysis

Investors and analysts are closely watching the Innd stock. Understanding its current market performance is crucial. Analyzing recent trends helps make informed decisions.

Recent Performance

In recent months, Innd stock has shown mixed results. The stock experienced fluctuations in its price. Some days saw significant gains. Other days recorded minor losses. This volatility is not uncommon. It’s influenced by various market factors. Investors should stay updated on these changes.

Market Trends

Several trends are impacting Innd stock. The technology sector is experiencing rapid growth. This growth affects Innd’s market position. Additionally, economic conditions play a role. Changes in interest rates can impact stock prices. Global events also influence market trends. Keeping an eye on these factors is important for potential investors.

Credit: fintel.io

Factors Influencing Innd Stock

Understanding the factors influencing Innd stock is crucial for investors. Many elements can affect its price and performance. By examining these factors, you can make better investment decisions.

Economic Indicators

Economic indicators play a significant role in influencing Innd stock. These indicators include inflation rates, employment figures, and GDP growth. High inflation can reduce consumer spending. This can lead to lower company revenues. Conversely, strong GDP growth often indicates a healthy economy. This can boost investor confidence.

Employment figures also impact stock prices. High employment rates usually mean more disposable income for consumers. This can lead to higher sales for companies. Monitoring these indicators can help predict stock performance.

Industry Developments

Industry developments can significantly impact Innd stock. Changes in technology, regulatory policies, and market trends are vital factors. For instance, technological advancements can create new opportunities. This can lead to increased demand for products and services.

Regulatory policies also play a crucial role. New regulations can either benefit or harm a company. Keeping an eye on these developments is essential for understanding stock movements.

Market trends can influence investor sentiment. Positive trends can attract more investors. Negative trends can lead to stock sell-offs. Staying updated with industry news can give you an edge in the market.

Technical Analysis

Technical analysis is essential for predicting stock performance. It involves evaluating securities through statistics and historical data. This analysis helps traders make informed decisions.

Price Patterns

Price patterns are crucial in technical analysis. They provide insights into future price movements. Here are some common patterns:

- Head and Shoulders: Indicates a trend reversal.

- Double Top and Bottom: Signals strong support or resistance levels.

- Triangles: Shows continuation or reversal of trends.

- Flags and Pennants: Suggests short-term price movements.

Recognizing these patterns helps traders anticipate market changes. They can then plan their strategies accordingly.

Volume Trends

Volume trends are another vital aspect. They show the intensity of market movements. Key points to consider:

- Rising Volume: Confirms the strength of a trend.

- Declining Volume: Indicates potential trend weakness.

- Volume Spikes: Often precede significant price changes.

Volume trends complement price patterns. Together, they provide a comprehensive view of stock behavior.

| Pattern | Indication |

|---|---|

| Head and Shoulders | Trend Reversal |

| Double Top and Bottom | Support/Resistance Levels |

| Triangles | Trend Continuation/Reversal |

| Flags and Pennants | Short-term Movements |

Understanding these elements helps traders improve their strategies. It enhances their chances of successful trades.

Fundamental Analysis

Understanding the fundamental analysis of Innd Stock is crucial for investors. This analysis involves examining the company’s financial health and growth potential. It helps investors make informed decisions.

Company Financials

Analyzing the company’s financials is the first step. Look at revenue, profit margins, and expenses. These metrics show the company’s financial health.

Here is a summary of Innd’s recent financial data:

| Metric | Value |

|---|---|

| Revenue | $10 million |

| Net Profit | $2 million |

| Operating Margin | 20% |

| Debt | $5 million |

This table shows Innd is profitable with healthy margins. The company has manageable debt levels.

Growth Potential

Next, assess the company’s growth potential. This involves looking at market trends and company initiatives. Innd operates in a growing industry. The demand for their products is increasing.

Consider the following factors:

- Industry Trends: Are there positive trends in the industry?

- Product Innovation: Is the company innovating and offering new products?

- Market Expansion: Is the company expanding into new markets?

Innd shows promise in all these areas. The industry is growing. The company is introducing new products. They are also expanding into new regions.

Investing in Innd could be a smart move. The company has strong financials and significant growth potential.

Expert Opinions

Investors often seek expert opinions to make informed decisions. Understanding the Innd Stock Forecast is no different. Financial experts provide valuable insights into the potential future performance of the stock. Below, we delve into analyst ratings and investment strategies.

Analyst Ratings

Analyst ratings are essential for predicting the future of a stock. Experts analyze various factors to rate the stock. These ratings can be:

- Strong Buy: Analysts expect the stock to perform very well.

- Buy: Analysts recommend purchasing the stock.

- Hold: Analysts suggest keeping the stock if you already own it.

- Sell: Analysts advise selling the stock.

- Strong Sell: Analysts predict the stock will perform poorly.

Understanding these ratings helps investors make better decisions. Experts often base their ratings on:

- Financial health of the company

- Market trends

- Recent news

- Company management

Investment Strategies

Different strategies can help investors maximize returns on Innd Stock. Some common strategies include:

- Long-term investing: Holding the stock for several years.

- Short-term trading: Buying and selling within a few days.

- Dollar-cost averaging: Regularly investing a fixed amount.

- Dividend investing: Focusing on stocks that pay dividends.

Choosing the right strategy depends on individual goals. Long-term investors might focus on the company’s growth potential. Short-term traders look at daily market movements.

Combining expert opinions and strategic planning can lead to more informed investment choices. Always consider your financial situation before investing.

Credit: walletinvestor.com

Risks And Challenges

Investing in stocks always involves risks and challenges. Understanding these can help investors make informed decisions. Here we explore some key risks and challenges related to Innd stock forecast.

Market Volatility

Stock markets are unpredictable. Prices can change rapidly. Innd stock is not immune to this. External factors like economic downturns or political changes can impact prices. Sudden news or events can lead to sharp declines. Investors should be prepared for this volatility.

Competitive Landscape

The market is crowded. Many companies offer similar products or services. Innd faces competition from established players and new entrants. This can impact its market share and profitability. Competitors may have more resources or better strategies. Keeping up with competition is a constant challenge.

Understanding these risks and challenges can help investors. Always consider these factors before making investment decisions.

Frequently Asked Questions

What Is Innd Stock Forecast?

The Innd stock forecast predicts future price movements based on market analysis. Experts use various tools and data to make predictions.

How Accurate Are Innd Stock Predictions?

Innd stock predictions can be accurate but are not guaranteed. Market conditions and unforeseen events can affect accuracy.

What Factors Influence Innd Stock Price?

Innd stock price is influenced by market trends, company performance, and economic conditions. Investor sentiment also plays a role.

Should I Invest In Innd Stock Now?

Investing in Innd stock depends on your financial goals and risk tolerance. Consult a financial advisor for personalized advice.

Conclusion

The Innd stock forecast shows great potential for future growth. Investors should stay updated on market trends. Research and careful planning are essential. Stay informed to make wise decisions. Consider consulting a financial advisor. The stock market can be unpredictable.

Always weigh risks and benefits. Keep track of company news. An informed investor is a successful investor. Keep your investment goals clear. Happy investing!