Introduction

Arvinas Inc., represented by the ticker ARVN on the stock exchange, has emerged as a focal point in the biotechnology sector, specializing in targeted protein degradation. This blog post aims to provide an in-depth analysis of ARVN stock, examining its historical performance, market trends, financial health, and future prospects.

ARVN Stock

ARVN stock represents shares in Arvinas Inc., a company at the forefront of the targeted protein degradation platform, revolutionizing treatments for diseases with unmet needs. This section delves into the basics of ARVN stock and its place in the biotech industry.

Historical Performance of ARVN Stock

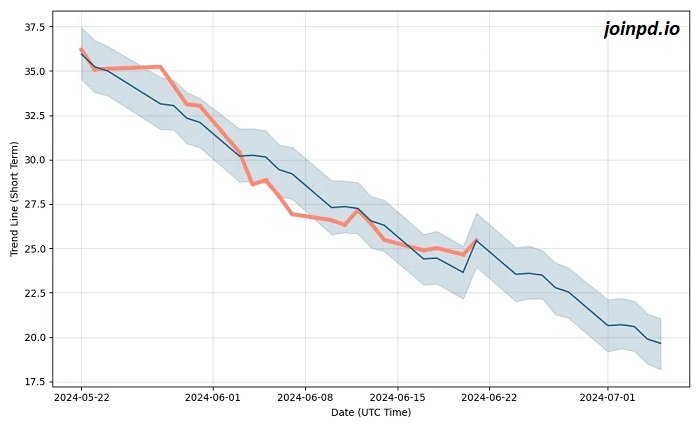

A detailed look at the historical performance of ARVN stock provides investors with insights into its volatility and growth patterns over the years. Analyzing past trends is crucial for understanding potential future behaviors of ARVN stock.

The Science Behind Arvinas Inc.

Arvinas Inc. is pioneering the use of PROTAC® technology to target and degrade disease-causing proteins. This section explores the scientific foundation of the company and how it supports the valuation of ARVN stock.

Financial Health and ARVN Stock

Reviewing the financial statements of Arvinas Inc. reveals the company’s economic stability and investment quality. Key financial metrics and their implications for ARVN stock are discussed here.

Market Trends Influencing ARVN Stock

ARVN stock is subject to various market forces and trends in the biotechnology sector. This analysis covers how global events, regulatory changes, and market sentiment impact ARVN stock.

Competitive Analysis of Arvinas Inc.

Understanding the position of Arvinas Inc. within the biotech industry involves examining its competitors and strategic advantages. This competitive analysis highlights what sets ARVN stock apart in a crowded market.

ARVN Stock and Investor Sentiment

Investor sentiment can greatly influence the performance of stocks like ARVN. This section assesses current investor attitudes towards ARVN stock and their potential effects on its market price.

Risks and Rewards of Investing in ARVN Stock

Every investment carries risks and rewards, and ARVN stock is no exception. This balanced view discusses the risks associated with ARVN stock, along with the potential rewards it offers to shareholders.

Future Outlook for ARVN Stock

Looking ahead, what does the future hold for ARVN stock? Predictions based on current data, upcoming trends, and company strategies are presented to give investors a forward-looking perspective.

ARVN Stock in the Context of Portfolio Diversification

Incorporating ARVN stock into an investment portfolio can aid in diversification. This section advises on how ARVN stock might fit into broader investment strategies focused on risk management and asset allocation.

Read more about satta-batta

Expert Opinions on ARVN Stock

Insights from financial analysts and industry experts provide additional perspectives on the potential of ARVN stock. This compilation of expert opinions helps shape a well-rounded view of ARVN stock.

ARVN Stock: The Verdict

Summing up the comprehensive analysis of ARVN stock, this final assessment provides potential investors with a clear picture of its investment viability and how it compares to other opportunities in the biotech sector.

Conclusion

ARVN stock offers a unique opportunity for investors interested in the biotech sector. With its innovative approach to disease treatment and solid financial footing, Arvinas Inc. is poised for potential growth. However, like any investment, ARVN stock comes with risks that need to be carefully considered. Investors should weigh these factors and consider their investment goals and risk tolerance before investing in ARVN stock.

FAQs on ARVN Stock

1. What does ARVN stock represent?

ARVN stock represents shares in Arvinas Inc., a biotechnology company specializing in targeted protein degradation technology.

2. How has ARVN stock performed historically?

ARVN stock has shown volatility typical of the biotech sector, with periods of significant growth and some declines, reflective of market and research developments.

3. What risks are associated with investing in ARVN stock?

Risks include scientific research challenges, regulatory hurdles, market volatility, and potential competition which can all impact the stock’s performance.

4. Can investing in ARVN stock diversify my portfolio?

Yes, investing in ARVN stock can add diversification, particularly for portfolios lacking exposure to the biotech sector.

5. Where can I buy ARVN stock?

ARVN stock can be purchased through any brokerage account that has access to NASDAQ, where Arvinas Inc. is listed.