Does Blackrock Own Everything? Unveiling the Truth

Does BlackRock own everything? The short answer is no, but their influence is vast.

BlackRock, the world’s largest asset manager, controls trillions in assets. Founded in 1988, BlackRock has grown exponentially. They manage investments for individuals, governments, and institutions. Their reach extends across various sectors, including tech, healthcare, and real estate. BlackRock’s significant holdings in major companies make them influential in many industries.

But owning everything? Not quite. They manage assets on behalf of clients, which means they don’t own the assets outright. This influence, however, raises questions about their power and impact on the global economy. In this blog post, we’ll explore BlackRock’s reach and its implications.

Introduction To Blackrock

Blackrock is a name often heard in the financial world. Many wonder about its influence and reach. To understand this, let’s delve into what Blackrock is and how it operates.

Company Background

Blackrock started in 1988. Larry Fink and a team of professionals founded it. They aimed to create a risk management and fixed income institution. Over the years, Blackrock expanded its services. It now offers a wide range of financial products. These include asset management, investment advisory, and risk management. Today, it stands as the world’s largest asset manager. Blackrock manages trillions of dollars for clients globally.

Global Influence

Blackrock’s influence spans the globe. It holds significant shares in many companies. This gives it a voice in corporate decisions. Its investment choices impact markets worldwide. Blackrock’s technology platform, Aladdin, is also widely used. Many institutions rely on it for risk management and analysis. This extends Blackrock’s reach and control. Its presence is felt in various sectors, from finance to technology. This makes Blackrock a key player in the global economy.

Blackrock’s Business Model

Blackrock’s Business Model is often a topic of interest due to its vast influence in the financial world. As one of the largest asset management firms globally, Blackrock has a unique way of operating. Its business model is designed to generate substantial returns for its clients and stakeholders. This section will explore the different facets of Blackrock’s business model, focusing on its Investment Strategies and Revenue Streams.

Investment Strategies

Blackrock employs a variety of investment strategies to manage its vast portfolio. These strategies are designed to maximize returns while minimizing risks.

- Passive Investing: Blackrock is known for its extensive use of passive investment strategies. This includes managing index funds and exchange-traded funds (ETFs).

- Active Management: Blackrock also engages in active management. This involves selecting specific stocks or bonds to outperform the market.

- Alternative Investments: The firm invests in alternative assets such as real estate, private equity, and commodities.

These diverse strategies help Blackrock cater to different client needs, whether they seek stable, long-term growth or higher-risk, higher-reward investments.

Revenue Streams

Blackrock generates revenue through various streams. Each stream contributes to its robust financial health.

| Revenue Stream | Description |

|---|---|

| Management Fees | Blackrock charges fees for managing assets. These fees are a percentage of the assets under management (AUM). |

| Advisory Fees | The firm provides advisory services to institutions and governments. It charges fees for this expertise. |

| Performance Fees | Blackrock earns performance fees when its funds achieve specific benchmarks. |

| Technology Services | The firm offers financial technology solutions like Aladdin. These services generate a significant portion of its revenue. |

Blackrock’s diverse revenue streams ensure its stability and growth. This allows the firm to continue expanding its influence in the financial world.

Major Holdings And Investments

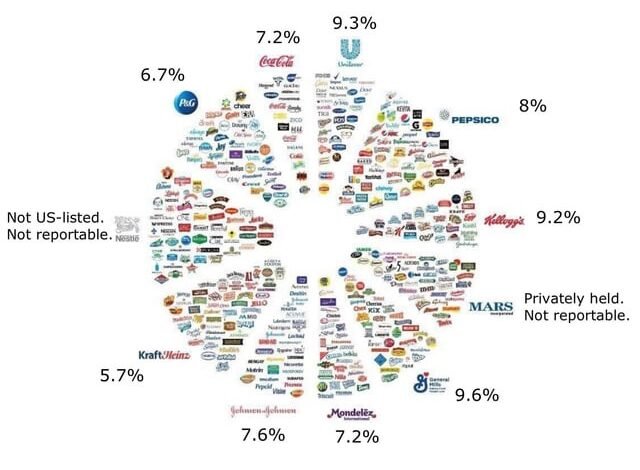

BlackRock is one of the largest asset management firms in the world. It oversees trillions of dollars in assets. Its major holdings and investments span various industries. This section will explore the key companies and sectors where BlackRock has significant influence.

Key Companies

BlackRock holds substantial shares in many leading companies. These include tech giants like Apple, Microsoft, and Google. It also invests heavily in financial institutions such as JPMorgan Chase and Bank of America. Retail giants like Amazon and Walmart are also part of its portfolio. These investments make BlackRock a powerful player in the global market.

Sector Dominance

BlackRock’s investments cover a wide range of sectors. Technology is a major focus, with large holdings in top tech firms. The financial sector is another area where BlackRock has strong influence. It holds significant shares in major banks and financial services companies. Healthcare is also a key sector, with investments in big pharma and biotech firms. Additionally, BlackRock has interests in energy, consumer goods, and industrials. These diverse investments help BlackRock maintain its dominance across multiple sectors.

Credit: www.youtube.com

Market Influence And Power

Blackrock Inc., a name that resonates power in the financial world. The company’s influence spans across various sectors and countries. Many wonder if Blackrock owns everything. While that might be an exaggeration, its market influence and power are undeniable.

Financial Markets

Blackrock manages trillions of dollars in assets. This makes it a giant in the financial markets. Its decisions can sway market trends. Investors watch Blackrock’s moves closely. The company’s strategies often set the tone for the market. With such control, Blackrock can affect global finance.

Its investment choices impact stock prices. When Blackrock buys shares, prices often rise. When it sells, prices can drop. This power gives Blackrock a significant role in the financial ecosystem. It isn’t just about the amount of money. It’s about the influence that money wields.

Corporate Governance

Blackrock holds stakes in many large corporations. This gives it a voice in corporate governance. The company uses its influence to push for changes. It often advocates for better practices and policies. This can include environmental, social, and governance (ESG) issues.

Its voting power in shareholder meetings is substantial. This means Blackrock can steer companies in certain directions. Its involvement in corporate governance isn’t just passive. Blackrock actively engages with company boards and management teams. This level of influence shapes how businesses operate.

Criticism And Controversies

Blackrock’s vast influence has sparked many debates. Critics argue that its power raises several ethical and regulatory issues. These concerns often question the company’s role in the financial market.

Ethical Concerns

Many believe Blackrock’s investments in diverse sectors create conflicts of interest. The company invests in both fossil fuels and green energy. This dual role raises questions about its true commitment to sustainability. Critics also worry about the social impact of its investment strategies.

For example, Blackrock owns significant shares in many large companies. This ownership gives it a strong voice in corporate decisions. Some argue that this can lead to prioritizing profit over people. Such actions can impact employee welfare and community well-being.

Regulatory Scrutiny

Regulators keep a close eye on Blackrock’s activities. They worry about the company’s market influence. Blackrock’s size means it can move markets with its decisions. This power can disrupt financial stability. Some experts call for stricter regulations to manage this influence.

There are concerns about the transparency of Blackrock’s operations. Critics argue that more disclosure is needed. They want to understand how Blackrock’s decisions affect the market. This scrutiny is essential to ensure fair competition and protect investors.

Credit: www.youtube.com

Impact On Global Economy

BlackRock is a major player in the global economy. Its influence extends across various sectors. Many wonder about its impact on the economy. Let’s explore this in detail.

Economic Policies

BlackRock has significant sway over economic policies. Governments consult BlackRock for financial advice. This advice can shape national policies. BlackRock’s recommendations often focus on market stability. This has a profound effect on global economies. It can lead to changes in regulations. These changes can favor large corporations.

Market Stability

Market stability is crucial for economic growth. BlackRock manages assets worth trillions of dollars. This gives it a strong presence in markets worldwide. Its decisions can impact market trends. Stability in the market attracts more investors. BlackRock’s role in maintaining stability is vital. It helps in reducing market volatility. This, in turn, boosts investor confidence.

Comparisons With Other Asset Managers

When discussing whether Blackrock owns everything, it’s essential to compare it with other major asset managers. Understanding how Blackrock stacks up against its competitors can provide a clearer picture. Let’s take a closer look at two of its biggest rivals: Vanguard and State Street.

Vanguard

Vanguard is another giant in the asset management world. It has a massive influence on global markets. While Blackrock boasts its significant assets under management (AUM), Vanguard is not far behind.

Both companies offer a range of investment products. These include mutual funds, ETFs, and retirement accounts. However, Vanguard is particularly famous for its low-cost index funds. This makes it a favorite among cost-conscious investors.

| Aspect | Blackrock | Vanguard |

|---|---|---|

| AUM (Approx.) | $9.5 Trillion | $7.3 Trillion |

| Founded | 1988 | 1975 |

| Number of Funds | 8,000+ | 400+ |

Vanguard’s structure is unique. It is owned by its funds, which are owned by their investors. This ensures that the company operates at cost, benefiting investors directly. In contrast, Blackrock is a publicly traded company with shareholders who expect profits.

State Street

State Street is another key player in the asset management industry. Like Blackrock, it manages trillions in assets and has a global reach.

State Street is particularly known for its SPDR ETFs. These are among the most popular exchange-traded funds in the market.

- Founded: 1792

- AUM (Approx.): $4.1 Trillion

- Number of Funds: 2,000+

State Street has a long history, dating back to 1792. It has a strong reputation in the industry. Its SPDR ETFs, especially the SPDR S&P 500 ETF, are widely recognized. This fund tracks the S&P 500 index and is a popular choice for investors.

While Blackrock and Vanguard may have larger AUMs, State Street remains a formidable competitor. Its product offerings and historical significance make it a crucial part of the asset management landscape.

Credit: www.reddit.com

Future Of Blackrock

The future of Blackrock holds significant interest for investors and market watchers. Known as one of the largest asset management firms, Blackrock’s strategies and decisions impact a vast number of industries and economies. Understanding its future trajectory helps gauge broader market trends.

Growth Prospects

Blackrock continues to explore new markets globally. Their focus on sustainable investments attracts eco-conscious investors. The rise in popularity of ETFs has also boosted their growth. Technological advancements, such as AI and data analytics, optimize their investment strategies. This keeps them ahead in the competitive market.

Challenges Ahead

Regulatory pressures pose a significant threat. Governments worldwide scrutinize large asset managers more closely. This leads to potential restrictions and compliance costs. Market volatility remains a constant challenge. Rapid changes in global economies affect their investments. Additionally, competition from other asset management firms grows. Staying innovative and adaptive becomes crucial for their future success.

Frequently Asked Questions

Does Blackrock Own Everything?

No, Blackrock does not own everything. Blackrock is a large investment management company. It manages assets for clients worldwide.

What Companies Does Blackrock Own?

Blackrock owns shares in many companies. It holds stakes in Apple, Microsoft, and Amazon. However, it does not fully own these companies.

How Much Of The Market Does Blackrock Control?

Blackrock controls a significant portion of the market. As of 2023, it manages about $9 trillion in assets.

Why Is Blackrock So Powerful?

Blackrock is powerful due to its vast assets under management. Its Aladdin platform also provides advanced financial data analytics.

Conclusion

Blackrock does not own everything, but it has significant influence. This power comes from its large assets under management. Investors should understand Blackrock’s role in the market. Knowledge about their holdings is crucial for informed decisions. While Blackrock’s reach is vast, it is not all-encompassing.

Staying aware of its impact helps navigate financial landscapes better. Remember, awareness is key. Always research thoroughly before investing.