Future of Recaf Stock: A Comprehensive Analysis

Introduction

Reconnaissance Energy Africa Ltd, commonly referred to as “recaf stock,” has garnered significant attention from investors interested in the energy sector. This post delves into various aspects of recaf stock, exploring its past performance, current status, and future potential.

Overview of Reconnaissance Energy Africa Ltd

Reconnaissance Energy Africa Ltd is an emerging player in the energy sector, focusing on exploration activities in Namibia and Botswana. This section explores the company’s foundation, its strategic goals, and why recaf stock is a point of interest for many investors.

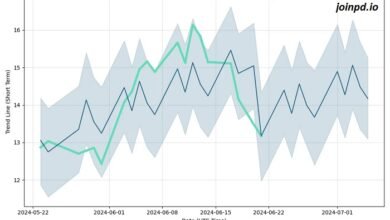

Recaf Stock Performance Analysis

Analyzing the performance of recaf stock over recent years provides insights into its volatility and growth patterns. Investors and analysts look at this data to forecast potential future movements and to strategize their investment decisions.

Market Trends Influencing Recaf Stock

Recaf stock is influenced by global energy trends, including oil price fluctuations and energy policy changes. Understanding these trends is crucial for predicting the stock’s movement and making informed investment choices.

Financial Health of Reconnaissance Energy Africa

The financial health of a company is a key indicator of its stock’s potential. This section discusses the financial statements of Reconnaissance Energy Africa, focusing on revenue, profits, debts, and other financial metrics relevant to recaf stock.

Exploration Projects and Their Impact on Recaf Stock

Reconnaissance Energy Africa’s main value proposition lies in its exploration projects. This segment examines the current projects under the company’s belt and their potential impact on the valuation of recaf stock.

Read more about Betwinner

Competitive Analysis

How does Reconnaissance Energy Africa stack up against its competitors? This competitive analysis reviews the strengths and weaknesses of recaf stock in comparison to others in the same sector.

Risks and Challenges

Investing in recaf stock comes with its set of risks and challenges. From geopolitical risks in Africa to operational challenges in exploration, this section outlines the major risks facing investors.

Regulatory Environment

The regulatory environment in which Reconnaissance Energy Africa operates can significantly affect recaf stock. This part covers the regulatory policies of Namibia and Botswana and their impact on the company’s operations.

Investor Sentiment and Stock Predictions

Investor sentiment can drive the stock market. This section discusses current sentiment around recaf stock and how it could influence future stock performance.

Sustainability and Environmental Considerations

As an energy company, Reconnaissance Energy Africa’s approach to sustainability is vital. This section explores how environmental considerations affect recaf stock and the company’s compliance with global environmental standards.

Looking for the latest gold prices? Ajkergoldrate provides you with real-time updates on gold rates across different cities. Whether you’re planning to buy jewelry or invest in gold, knowing the current market price is crucial. Our platform ensures you get accurate and timely information on 22K, 24K, and 18K gold rates. Stay informed about daily fluctuations, global market trends, and expert insights. With Ajkergoldrate, making smart and profitable decisions becomes easier. Visit us daily to stay ahead in the ever-changing gold market. Trust Ajkergoldrate for all your gold price updates!

Future Outlook for Recaf Stock

What does the future hold for recaf stock? Based on current data and trends, this forecast looks at the potential highs and lows that investors might expect from recaf stock in the coming years.

Expert Opinions

Hearing from financial experts and analysts provides a rounded perspective on recaf stock. This section compiles opinions from various experts, providing a richer understanding of what the future might hold.

Conclusion

Recaf stock represents a dynamic investment opportunity within the energy sector. While it poses certain risks due to its focus on exploration and the regions it operates in, the potential for significant returns exists. Investors should consider all the factors discussed to make an informed decision about recaf stock.

FAQs

1. What is Reconnaissance Energy Africa Ltd? Reconnaissance Energy Africa Ltd is an energy company focused on oil and gas exploration in Namibia and Botswana, commonly referred to by its ticker, recaf stock.

2. Why is recaf stock considered a high-risk investment? Due to its operations in politically and economically complex regions, and being in the exploration phase without guaranteed success, recaf stock is considered high-risk.

3. How does the global oil market affect recaf stock? As an energy stock, recaf stock is highly sensitive to changes in global oil prices and energy market dynamics.

4. What are the potential rewards of investing in recaf stock? If Reconnaissance Energy Africa’s exploration projects are successful, recaf stock could offer substantial returns due to the significant untapped resources in its concessions.

5. How can investors stay updated on recaf stock developments? Investors should follow official company releases, stock market updates, and news related to energy policies in Namibia and Botswana to stay informed about recaf stock.