Icahn Enterprises Stock: A Comprehensive Guide

Introduction

Icahn Enterprises stock has long been a topic of interest for investors looking to diversify their portfolios. As a publicly traded diversified holding company, Icahn Enterprises L.P. offers exposure to a variety of industries, making its stock a unique investment. This blog post delves into the details of Icahn Enterprises stock, covering its history, performance, financials, and more.

History of Icahn Enterprises

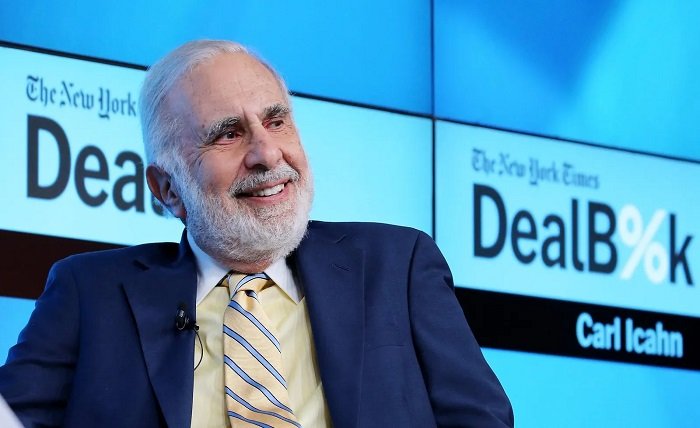

Icahn Enterprises L.P., founded by Carl Icahn, is a diversified conglomerate with investments in various industries. Icahn Enterprises stock has been publicly traded since 1987, offering investors a chance to align with the vision of one of Wall Street’s most renowned activists. Understanding the history of Icahn Enterprises stock helps investors appreciate the evolution and strategic shifts that have shaped its current portfolio.

Business Model and Diversification

Icahn Enterprises operates through several segments, including Investment, Energy, Automotive, Food Packaging, Metals, Real Estate, Home Fashion, and Pharma. The diversification of Icahn Enterprises stock allows investors to benefit from a wide array of economic sectors. This diversification mitigates risks and enhances the potential for steady returns.

Financial Performance

Analyzing the financial performance of Icahn Enterprises stock provides insights into its viability as an investment. Key financial metrics such as revenue, net income, and EBITDA are crucial in assessing the company’s financial health. Over the years, Icahn Enterprises stock has shown resilience and adaptability, reflecting the strategic acumen of its leadership.

Read more about: revolver news

Dividend Policy

Investors often look for dividend-paying stocks to generate passive income. Icahn Enterprises stock is known for its attractive dividend yield, making it a popular choice among income-focused investors. Understanding the dividend policy of Icahn Enterprises stock, including payout ratios and historical dividend payments, is essential for evaluating its suitability for a dividend portfolio.

Recent Stock Performance

Recent performance trends of Icahn Enterprises stock provide a snapshot of its market behavior. Examining price movements, trading volumes, and market sentiment over the past year helps investors gauge the stock’s volatility and potential for future growth. Icahn Enterprises stock has experienced fluctuations, reflecting broader market conditions and company-specific developments.

Read more about: revolver news

Investment Strategies

Investing in Icahn Enterprises stock requires a strategic approach. Whether you’re a long-term investor or a short-term trader, understanding different investment strategies can enhance your decision-making process. Some investors prefer holding Icahn Enterprises stock for its dividends and potential appreciation, while others might trade based on market trends and news.

Risks and Challenges

Like any investment, Icahn Enterprises stock comes with its share of risks and challenges. Market volatility, economic downturns, and industry-specific issues can impact the stock’s performance. It’s crucial for investors to be aware of these risks and consider them when making investment decisions. Diversification within a portfolio can help mitigate some of the risks associated with holding Icahn Enterprises stock.

Market Competition

Icahn Enterprises operates in competitive industries, and understanding its position relative to competitors is vital. Analyzing the competitive landscape helps investors assess the strengths and weaknesses of Icahn Enterprises stock. The company’s strategic acquisitions and divestitures play a significant role in maintaining its competitive edge.

Management and Leadership

The leadership team behind Icahn Enterprises significantly influences its performance. Carl Icahn, known for his activist investing style, has been instrumental in shaping the company’s direction. Evaluating the management team’s track record and strategic decisions provides insights into the future prospects of Icahn Enterprises stock.

Future Outlook

The future outlook of Icahn Enterprises stock depends on various factors, including market conditions, industry trends, and company-specific strategies. Analyzing growth opportunities and potential challenges helps investors form a well-rounded perspective. Icahn Enterprises stock is poised to benefit from strategic initiatives and market developments in its diverse portfolio.

Analyst Opinions

Financial analysts provide valuable insights and ratings on stocks. Reviewing analyst opinions on Icahn Enterprises stock can help investors make informed decisions. Analysts consider factors such as financial performance, market trends, and company announcements when providing their ratings and target prices for Icahn Enterprises stock.

How to Invest in Icahn Enterprises Stock

Investing in Icahn Enterprises stock involves understanding the mechanics of stock trading. Investors can purchase Icahn Enterprises stock through brokerage accounts, mutual funds, or exchange-traded funds (ETFs) that include the stock. It’s important to consider factors such as brokerage fees, trading platforms, and investment goals when buying Icahn Enterprises stock.

Conclusion

Icahn Enterprises stock represents a compelling investment opportunity for those seeking diversification and potential returns. With a rich history, diversified portfolio, and strategic leadership, the stock offers a unique blend of stability and growth potential. However, like any investment, it comes with risks that investors must consider. By staying informed and adopting a strategic approach, investors can make the most of their investment in Icahn Enterprises stock.

FAQs

1. What is Icahn Enterprises?

Icahn Enterprises L.P. is a diversified holding company founded by Carl Icahn, with investments in various industries such as Energy, Automotive, Food Packaging, Metals, Real Estate, Home Fashion, and Pharma. Icahn Enterprises stock is publicly traded, offering investors exposure to these diverse sectors.

2. How has Icahn Enterprises stock performed historically?

Icahn Enterprises stock has shown resilience and adaptability over the years, reflecting the strategic decisions made by its leadership. Its performance has been influenced by market conditions, economic cycles, and company-specific developments.

3. What is the dividend yield of Icahn Enterprises stock?

Icahn Enterprises stock is known for its attractive dividend yield, making it popular among income-focused investors. The exact yield can vary over time, so investors should check the latest dividend announcements and payout ratios.

4. What are the risks associated with investing in Icahn Enterprises stock?

Investing in Icahn Enterprises stock comes with risks such as market volatility, economic downturns, and industry-specific challenges. Diversification and thorough research can help mitigate some of these risks.

5. How can I buy Icahn Enterprises stock?

Investors can buy Icahn Enterprises stock through brokerage accounts, mutual funds, or ETFs that include the stock. It’s important to consider factors such as brokerage fees, trading platforms, and investment goals when purchasing the stock.