Investing in Rum: Unlocking Profitable Opportunities

Investing in rum is gaining popularity among collectors and enthusiasts. This unique asset class offers both enjoyment and potential financial rewards.

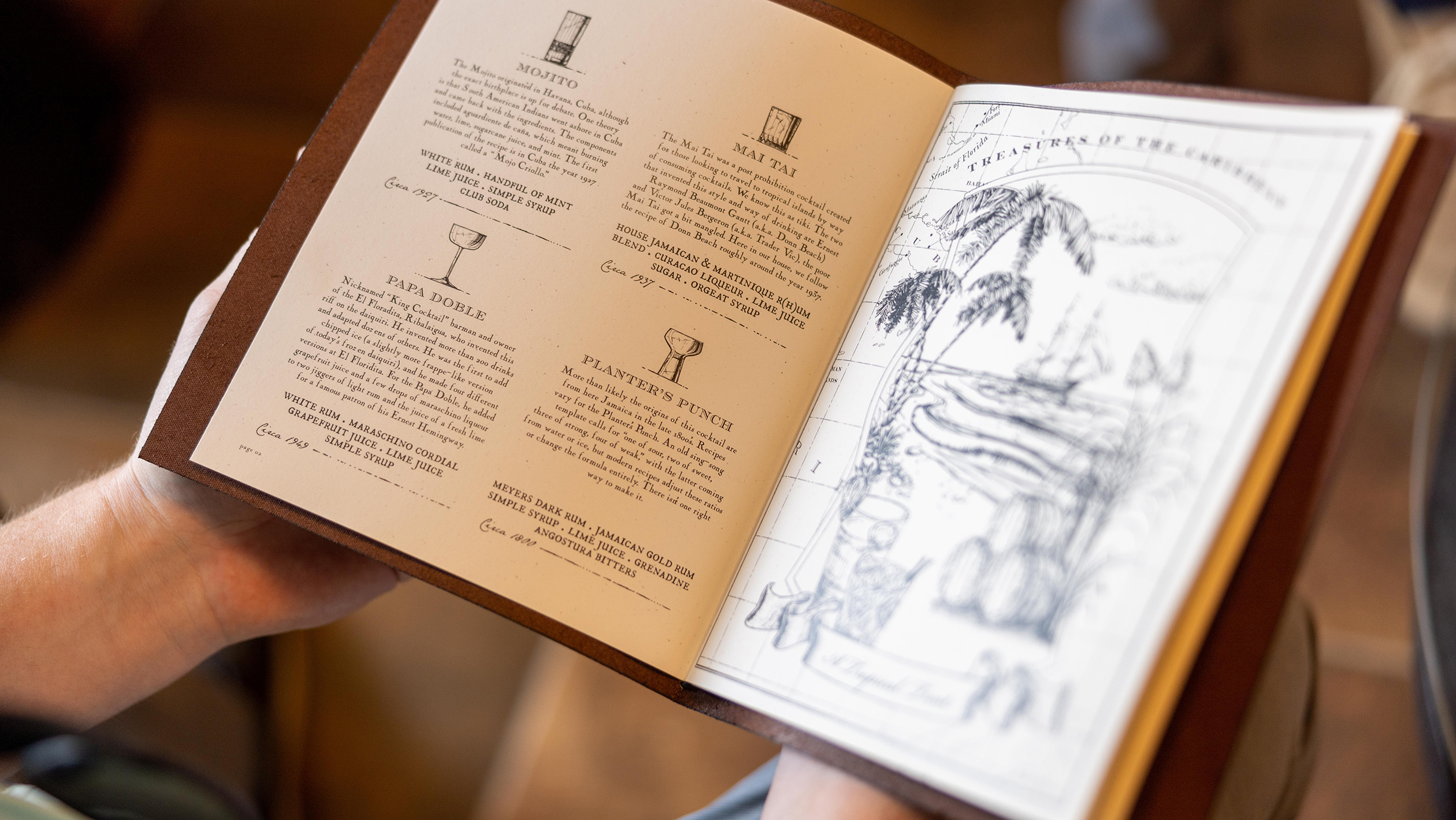

Rum, once merely a drink for sailors and pirates, has evolved into a sought-after investment. With its rich history and diverse flavor profiles, rum attracts investors looking for alternative assets. The market for premium and rare rums is expanding, making it an intriguing option for those interested in diversifying their portfolio.

Investing in rum isn’t just about the potential returns; it’s also about the experience. From understanding different distilleries to appreciating the craftsmanship, there is much to learn and enjoy. In this blog, we will explore the reasons why investing in rum might be a wise choice. Join us as we delve into this fascinating world.

Introduction To Rum Investment

Discover the world of rum investment. This unique venture offers a blend of culture, history, and potential profit. Collectors and investors alike find value in aged and rare bottles.

Investing in rum is gaining popularity. It offers unique opportunities for collectors and investors. Rum, a distilled alcoholic beverage, has a rich history and cultural significance. Understanding its value can lead to profitable investments.What Makes Rum Valuable?

Rum’s value depends on several factors. Age is a primary factor. Older rums often fetch higher prices. Limited editions and rare bottles also attract high demand. The production method can impact value. Handcrafted and small-batch rums are usually more valuable. The brand and its reputation play a significant role too.Historical Significance Of Rum

Rum has a storied past. It dates back to the 17th century. It played a crucial role in the Caribbean economy. Sailors and pirates popularized rum during maritime voyages. It became known as a symbol of adventure and rebellion. Today, its historical significance adds to its investment appeal. “`Types Of Rum For Investment

Investing in rum can be a rewarding venture. The rich history, diversity, and unique aging process make rum a valuable asset. Different types of rum offer varied investment opportunities.

Aged Rums

Aged rums are highly sought after by collectors. They spend years maturing in barrels. This aging process enhances their flavor and value. The longer the rum ages, the more complex its taste. This makes aged rums a great choice for investment. Examples include 12-year, 18-year, and 21-year aged rums. These rums often come from well-known distilleries. Their limited availability increases their desirability and market value.

Limited Edition Rums

Limited edition rums are another excellent investment option. These rums are produced in small quantities. They often celebrate special occasions or milestones. Limited edition rums usually have unique packaging. This makes them attractive to collectors. Some limited editions are collaborations with famous artists or brands. Their rarity and unique features drive up their value. Investing in limited edition rums can offer significant returns.

Market Trends In Rum Investing

Investing in rum has gained popularity in recent years. Collectors and investors are finding value in rare and aged bottles. Understanding market trends can help make informed decisions.

Current Market Dynamics

The current rum market is showing steady growth. Demand for premium and aged rums is increasing. Collectors are particularly interested in limited editions and rare finds.

- Premium Brands: Brands like Mount Gay and Appleton Estate are highly sought after.

- Limited Editions: Bottles with limited releases are in high demand.

- Aged Rums: Older rums are becoming valuable assets.

These trends show that the market is maturing. More investors are entering, looking for unique opportunities.

Future Market Predictions

The future of rum investing looks promising. Experts predict continued growth in the premium rum segment. The market is expected to see more innovation and new releases.

Here are some key predictions:

- Increased Demand: More consumers will seek high-quality rums.

- Rising Prices: Limited and aged rums will become more expensive.

- New Markets: Emerging markets will show interest in premium rums.

These trends suggest a positive outlook for rum investors. Staying informed and understanding these dynamics can lead to successful investments.

Identifying Authentic And Quality Rums

Investing in rum can be rewarding. But, how do you identify authentic and quality rums? Understanding the key factors can help you make informed decisions. This section will explore methods to recognize key distilleries and evaluate rum quality.

Recognizing Key Distilleries

Identifying reputable distilleries is crucial. Not all distilleries produce high-quality rum. Here are some tips:

- Look for distilleries with a long history. Brands with decades or centuries of experience tend to produce better rum.

- Check if the distillery uses traditional methods. Authentic rums often come from distilleries using time-tested processes.

- Research awards and accolades. Distilleries with numerous awards usually indicate quality.

| Distillery | Location | Years of Operation |

|---|---|---|

| Appleton Estate | Jamaica | Over 270 years |

| Mount Gay | Barbados | Over 300 years |

| Ron Zacapa | Guatemala | Over 40 years |

Evaluating Rum Quality

Evaluating the quality of rum involves a few key steps. Each step helps ensure you select the best product.

- Check the Age: Older rums often have richer flavors. Look for age statements on the label.

- Examine the Color: Quality rums usually have a deep, rich color. This indicates good aging.

- Read the Label: Labels can reveal a lot. Look for phrases like “single cask” or “limited edition.”

- Smell and Taste: Authentic rums have complex aromas and flavors. Notes of vanilla, caramel, and spices are common.

By recognizing key distilleries and evaluating rum quality, you can confidently invest in the best rums. Always stay informed and make educated choices.

Building A Rum Collection

Investing in rum can be an exciting and rewarding hobby. Building a rum collection not only allows you to enjoy a variety of flavors but also offers potential financial benefits. Below, we’ll explore the steps to start and expand your rum collection.

Starting Small

Begin with a few bottles of quality rum. Focus on different types to understand their unique characteristics.

- White Rum: Light and versatile, perfect for cocktails.

- Golden Rum: Aged and rich, with a smooth flavor.

- Dark Rum: Deep and full-bodied, ideal for sipping.

Start with brands that are well-known for their quality. Purchase bottles from regions famous for rum production, such as the Caribbean. This ensures you get a good representation of what each type has to offer.

Expanding Your Collection

As you become more familiar with rum, expand your collection by exploring more specialized and rare bottles. Consider these options:

- Limited Editions: These can be valuable due to their rarity.

- Aged Rums: Older rums often have complex flavors and higher value.

- Small Batch Rums: Produced in limited quantities, offering unique tastes.

Keep an eye on auctions and specialty stores. They often have rare finds that can enhance your collection. Don’t hesitate to invest in protective cases to preserve the quality of your bottles.

Document your collection. Keep track of each bottle’s purchase date, price, and origin. This can be useful for future reference and valuation.

Storing And Preserving Rum

Investing in rum can be both enjoyable and profitable. To get the best returns, proper storage and preservation are key. This ensures that your rum maintains its quality and value over time.

Ideal Storage Conditions

Store rum in a cool, dark place. Direct sunlight can harm the flavor. The temperature should remain steady, ideally between 15-20 degrees Celsius. Avoid places with high humidity. Moisture can damage labels and corks. A wine cellar or a dedicated liquor cabinet works well. Ensure bottles are upright to prevent cork drying.

Preventing Degradation

Keep rum sealed tightly. Air exposure can cause oxidation, degrading flavor. Check the seal regularly for any leaks. Use wax seals for long-term storage. Keep away from strong odors. Rum can absorb smells from its surroundings. A dedicated storage space prevents this issue. Regularly inspect bottles for any signs of leakage or spoilage.

Selling Your Rum Collection

Investing in rum can be a rewarding experience. But at some point, you might want to sell your collection. Selling your rum collection can be both exciting and profitable. This section will help you understand how to find buyers and set the right price for your collection.

Finding Buyers

Finding the right buyers for your rum collection is essential. The following are some effective ways to reach potential buyers:

- Online Marketplaces: Websites like eBay and specialized rum forums are great places to list your collection.

- Auction Houses: Consider reputable auction houses that specialize in rare spirits.

- Social Media: Use platforms like Facebook and Instagram to reach out to rum enthusiasts.

- Local Collectors: Join local rum clubs or attend events to meet potential buyers.

Each of these methods has its advantages. Choose the one that suits your needs best.

Setting The Right Price

Setting the right price for your rum collection is crucial. Consider these factors:

- Rarity: Rare bottles often fetch higher prices.

- Condition: Bottles in mint condition are more valuable.

- Age: Older rums can be more desirable.

- Market Trends: Keep an eye on current trends in the rum market.

Here is a simple table to help you set the right price:

| Factor | Impact on Price |

|---|---|

| Rarity | High |

| Condition | Medium to High |

| Age | Medium |

| Market Trends | Variable |

Research and compare prices of similar bottles. This helps ensure you set a competitive price for your collection.

Credit: whiskypartners.com

Legal And Tax Considerations

Investing in rum can be an exciting venture. Yet, it is crucial to understand the legal and tax considerations involved. These aspects ensure your investments are compliant and profitable.

Understanding Regulations

Before investing, research the regulations in your country. Different regions have varying laws about alcohol investments. Ensure you know these laws to avoid legal issues.

Some important regulations include:

- Licensing requirements

- Import and export restrictions

- Storage and transportation rules

Consult with a legal expert to understand these rules thoroughly.

Managing Tax Implications

Investing in rum has tax implications. Understanding these can save you money. Here are some key points:

| Tax Type | Description |

|---|---|

| Capital Gains Tax | Tax on profit when you sell rum investments. |

| Excise Tax | Tax on the production and sale of rum. |

| Import Duties | Taxes on rum brought into the country. |

Keep detailed records of your transactions. This helps in managing and reporting taxes accurately. Consult with a tax advisor to optimize your tax strategy.

Success Stories In Rum Investing

Investing in rum has become a profitable and exciting venture. Many investors have found substantial returns. Let’s explore some remarkable success stories in rum investing.

Notable Investors

There are several notable investors who have made their mark in the rum industry.

- Richard Seale: A pioneer in the rum world. He transformed Foursquare Distillery into a renowned brand.

- Mark Reynier: Known for his work with Bruichladdich, he ventured into rum with Renegade Rum.

- Jefferson’s founder, Trey Zoeller: He created Jefferson’s Ocean Aged at Sea, a unique rum aged at sea.

High-value Sales

High-value sales in rum investing demonstrate the potential for significant returns.

| Year | Rum | Sale Price |

|---|---|---|

| 2019 | The Last Drop 1976 | $4,000 per bottle |

| 2020 | Appleton Estate 50 Year Old | $5,000 per bottle |

| 2021 | Havana Club Maximo | $3,500 per bottle |

These sales highlight the value and demand for premium rum. Investing in the right rum can yield impressive returns.

Credit: www.thethreedrinkers.com

Credit: daily.sevenfifty.com

Frequently Asked Questions

What Is Rum Investing?

Rum investing involves purchasing rare and premium bottles of rum with the expectation that their value will increase over time. Collectors and investors seek out limited editions, aged varieties, and unique labels.

Why Invest In Rum?

Investing in rum can be profitable due to its increasing popularity and limited supply. Rare bottles often appreciate in value, offering potential financial returns.

How To Start Investing In Rum?

Begin by researching reputable rum brands and understanding market trends. Purchase from trusted sources, focusing on rare and aged bottles for better investment potential.

What Factors Affect Rum Value?

Rum value is influenced by age, rarity, brand reputation, and market demand. Limited editions and discontinued bottles are often more valuable.

Conclusion

Investing in rum offers a unique opportunity. It combines history, culture, and potential profit. Diversifying your portfolio with rum can be rewarding. Research and patience are key. Understand the market trends and invest wisely. Always consider quality over quantity. Rum investment isn’t just about money.

It’s about passion and appreciation for fine spirits. So, explore this exciting avenue. Start small, learn, and grow your collection over time. Enjoy the journey and the potential returns. Happy investing!