Navigating the Ups and Downs of NRT Stock: An Investor’s Guide

Introduction

Navigating the world of investments can be challenging, especially when dealing with volatile stocks like NRT. This blog post aims to provide a comprehensive guide to understanding NRT stock, its performance, market implications, and strategies for savvy investing. Whether you’re a seasoned investor or new to the stock market, this guide will equip you with the knowledge you need to make informed decisions about NRT stock.

NRT Stock

NRT stock, associated with a real estate investment trust (REIT), has shown variable performance trends over the years. Analyzing its past can provide insights into potential future behavior. This section delves into what NRT stock represents and its role in the financial markets.

Historical Performance of NRT Stock

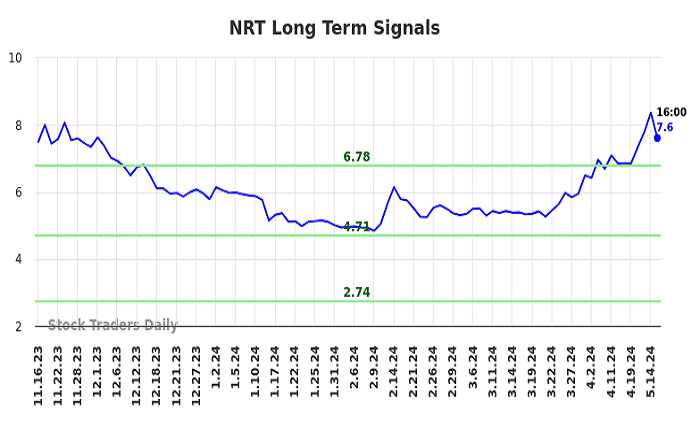

The historical data of NRT stock reveals patterns of highs and lows, influenced by market conditions, economic indicators, and company-specific news. Understanding these trends is crucial for predicting future movements and making informed investment decisions.

Market Analysis for NRT Stock

Current market conditions play a significant role in the performance of NRT stock. This section examines the external factors impacting NRT, including economic trends, sector health, and regulatory changes that could affect its valuation.

Investment Strategies for NRT Stock

Investing in NRT stock requires strategic thinking. This part of the blog discusses different approaches, such as long-term holding, short-selling, and diversification. Each strategy is tailored to fit various investor profiles and their risk tolerance.

Risk Management in NRT Stock Investments

Managing risk is paramount when investing in stocks like NRT. Here, we explore risk assessment techniques and tools that can help investors mitigate losses and optimize returns despite the stock’s volatility.

NRT Stock and REIT Fundamentals

Understanding the basics of real estate investment trusts is essential for NRT stock investors. This section breaks down how REITs work, their financial structure, and how these factors influence NRT stock performance.

Comparing NRT Stock with Other REITs

Comparative analysis can illuminate the strengths and weaknesses of NRT stock in the broader REIT market. This comparison helps investors position NRT within their portfolios more effectively.

Future Outlook for NRT Stock

Forecasting the future of NRT stock involves examining current trends, potential market shifts, and upcoming financial reports. This forecast helps investors plan their next moves.

Dividends and Returns from NRT Stock

One of the appeals of REITs like NRT is their dividend yield. This section discusses the dividend history of NRT stock, payout ratios, and what investors might expect in future distributions.

NRT Stock in Global Markets

The performance of NRT stock is not isolated to domestic markets. Here, we assess its impact and presence in global financial markets, offering a broader perspective on its investment potential.

NRT Stock and Technological Innovations

Technological advancements can significantly impact real estate markets and, by extension, NRT stock. This part examines how emerging technologies are influencing the REIT sector and what that means for NRT.

Legal and Regulatory Considerations for NRT Stock

Investors must be aware of the legal and regulatory environment surrounding NRT stock. This section covers recent changes in legislation and regulations that could affect NRT stock investments.

Conclusion

NRT stock presents both opportunities and challenges for investors. By understanding its market dynamics, historical performance, and strategic investment approaches, you can better navigate its volatility. Remember, successful investing in NRT stock requires a balanced approach to risk and a thorough understanding of market conditions.

FAQs

1. What is NRT stock?

NRT stock refers to the shares of a publicly traded real estate investment trust known for its volatility and potential for significant returns.

2. How does NRT stock compare to other REITs?

NRT stock may offer higher dividend yields compared to some REITs, though it also comes with higher volatility and risks.

3. What are the key risks of investing in NRT stock?

Key risks include market volatility, changes in real estate market conditions, and regulatory changes that could impact the REIT industry.

4. Can technological advancements affect NRT stock?

Yes, technological improvements in real estate management and investment platforms can influence the performance and valuation of NRT stock.

5. How should I approach investing in NRT stock?

Investors should consider a diversified portfolio, assess their risk tolerance, and stay informed about market and economic indicators affecting NRT stock.