Potential of STNE Stock: A Comprehensive Analysis

Investing in the stock market can be daunting, especially when it comes to identifying stocks with high growth potential. One such stock that has been garnering significant attention is STNE stock. In this blog post, we will delve deep into the nuances of STNE stock, exploring its market performance, growth prospects, and much more. Whether you are a seasoned investor or a beginner, this comprehensive analysis will provide you with valuable insights into STNE stock.

STNE Stock

STNE stock refers to the shares of StoneCo Ltd, a leading fintech company based in Brazil. StoneCo provides financial technology solutions to merchants and partners, including point-of-sale systems, e-commerce solutions, and payment processing services. As a publicly traded company on the NASDAQ under the ticker symbol STNE, its stock has attracted considerable attention from investors globally.

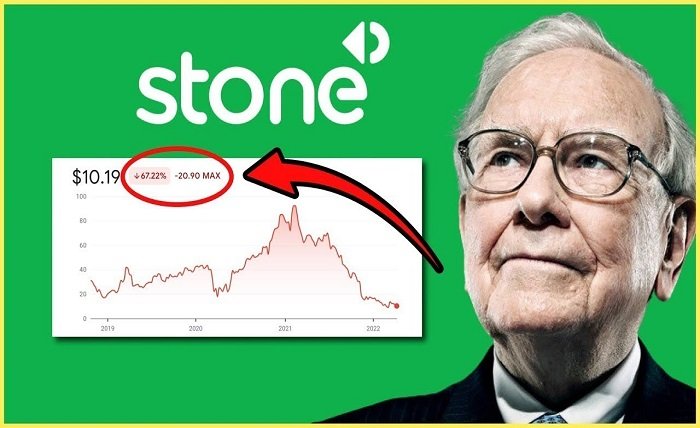

Market Performance of STNE Stock

Analyzing the market performance of STNE stock reveals a mixed yet promising picture. Since its IPO in October 2018, STNE stock has experienced significant fluctuations, influenced by market conditions, economic factors, and company performance. Despite these fluctuations, STNE stock has shown resilience and potential for long-term growth, making it an intriguing option for investors.

Financial Health and Stability

The financial health of a company is crucial for determining the viability of its stock. STNE stock benefits from StoneCo’s solid financial foundation. The company has demonstrated strong revenue growth, driven by its expanding merchant base and increased adoption of its services. Investors should consider StoneCo’s profitability, debt levels, and cash flow when evaluating STNE stock.

Growth Prospects of STNE Stock

Growth prospects play a pivotal role in the attractiveness of any stock. STNE stock is positioned well due to StoneCo’s continuous innovation and expansion efforts. The company is actively investing in new technologies and expanding its product offerings, which can drive future growth. Additionally, StoneCo’s strategic partnerships and acquisitions further bolster the growth potential of STNE stock.

Competitive Landscape

Understanding the competitive landscape is essential for assessing the potential risks and opportunities associated with STNE stock. StoneCo operates in a highly competitive market, facing competition from other fintech companies and traditional financial institutions. However, StoneCo’s unique value proposition, strong brand recognition, and customer-centric approach give STNE stock a competitive edge.

Risk Factors to Consider

Investing in STNE stock, like any other stock, comes with its share of risks. Economic volatility, regulatory changes, and market competition are some of the key risks that can impact the performance of STNE stock. Additionally, StoneCo’s exposure to the Brazilian market adds another layer of risk. Investors should carefully consider these factors before making investment decisions.

Expert Opinions on STNE Stock

Expert opinions can provide valuable insights into the potential of STNE stock. Financial analysts and industry experts have mixed views on STNE stock, with some highlighting its growth potential and others pointing out the risks. It is essential to consider diverse perspectives and conduct thorough research before investing in STNE stock.

Long-term Investment Potential

For investors with a long-term horizon, STNE stock offers compelling potential. StoneCo’s strategic initiatives, such as expanding its customer base, enhancing technological capabilities, and entering new markets, can drive sustained growth. Long-term investors should evaluate the company’s vision and strategic direction when considering STNE stock.

Short-term Trading Opportunities

Short-term traders can also find opportunities with STNE stock. Market volatility and news events can create short-term price movements, presenting trading opportunities. However, short-term trading requires a deep understanding of market dynamics and the ability to react quickly to changes. Traders should stay updated on news and events impacting STNE stock.

Conclusion

STNE stock represents an intriguing investment opportunity in the fintech sector. With its strong financial foundation, growth prospects, and competitive edge, StoneCo has positioned itself as a key player in the market. However, investors must carefully consider the associated risks and conduct thorough research before investing in STNE stock. Whether you are a long-term investor or a short-term trader, understanding the intricacies of STNE stock is crucial for making informed investment decisions.

FAQs

1. What is STNE stock? STNE stock refers to the shares of StoneCo Ltd, a Brazilian fintech company providing financial technology solutions to merchants and partners.

2. How has STNE stock performed in the market? Since its IPO in 2018, STNE stock has experienced significant fluctuations, reflecting market conditions and company performance. Despite these fluctuations, it has shown potential for long-term growth.

3. What are the growth prospects of STNE stock? STNE stock’s growth prospects are driven by StoneCo’s continuous innovation, expansion efforts, strategic partnerships, and acquisitions.

4. What risks are associated with investing in STNE stock? Key risks include economic volatility, regulatory changes, market competition, and exposure to the Brazilian market.

5. Should I invest in STNE stock for the long term or short term? STNE stock offers potential for both long-term and short-term investments. Long-term investors should focus on the company’s strategic initiatives, while short-term traders should consider market volatility and news events.