Twilio: A Deep Dive into TWLO Stock

Introduction

Twilio has become a prominent player in the cloud communications sector, offering a range of services that empower developers to build and manage communication tools. The performance of TWLO stock offers insights into not only the company’s financial health but also its position in the competitive tech landscape. In this article, we’ll take an in-depth look at Twilio, exploring its stock performance, the factors driving its market valuation, and what future trends could influence its trajectory.

Twilio’s Business Model

Twilio operates on a platform-as-a-service (PaaS) model, which has disrupted traditional communication systems by enabling software developers to integrate voice, text, and other communication services into their applications using web service APIs. The scalability and flexibility of Twilio’s offerings make TWLO stock an interesting prospect for investors looking at growth in cloud-based services.

Financial Overview of TWLO Stock

Analyzing the financial health of Twilio is crucial for understanding its stock performance. We’ll examine key financial metrics such as revenue growth, profit margins, and earnings per share. TWLO stock has shown volatile yet promising trends, reflecting the company’s aggressive growth strategy and its impact on profitability.

Market Performance and Trends

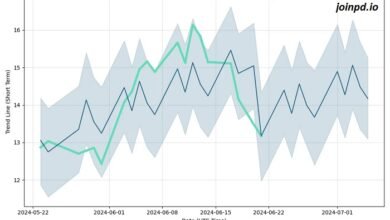

TWLO stock has experienced significant fluctuations. Market trends influencing these movements include technological advancements, competition, and the overall economic climate. This section will analyze past market performance and the external factors affecting TWLO stock.

Competitive Landscape

Twilio operates in a highly competitive environment with both direct and indirect competitors. Companies like SendGrid (which Twilio acquired), Bandwidth Inc., and Nexmo compete in the same space. Understanding this landscape is key to assessing TWLO stock’s potential and the company’s market share.

Technological Innovations by Twilio

Innovation is at the heart of Twilio’s strategy. Recent technological advancements and product launches by Twilio have made TWLO stock even more intriguing to tech investors. We’ll discuss how these innovations position Twilio ahead of its competitors.

Investor Sentiment and Stock Analysis

Investor sentiment plays a vital role in the stock’s performance. This section will explore how investor perceptions of Twilio’s market position, financial health, and future prospects are reflected in TWLO stock prices.

Regulatory and Economic Factors

Like any tech company, Twilio faces regulatory challenges that could impact its operations and, consequently, TWLO stock. This part will cover potential regulatory hurdles and economic factors that could influence Twilio’s business operations.

Future Outlook for TWLO Stock

What does the future hold for TWLO stock? We’ll provide an analysis of potential growth areas for Twilio, including international expansion and new product offerings, and discuss how these could influence TWLO stock in the coming years.

Impact of Global Events

Global events, such as economic downturns or technological breakthroughs, can significantly impact TWLO stock. This section will analyze recent events and their effects on Twilio’s market performance.

Strategies for Investors

For those interested in TWLO stock, it’s essential to have a strategy. We’ll offer insights on various approaches to investing in Twilio, considering both short-term gains and long-term growth potential.

Social Responsibility and Corporate Governance

Twilio’s commitment to social responsibility and robust corporate governance could enhance its brand reputation and investor confidence in TWLO stock. Here, we examine Twilio’s efforts in these areas.

Conclusion

Twilio’s integration of cutting-edge technology and a strong market presence makes TWLO stock a noteworthy candidate for portfolio consideration. However, like any investment, it carries risks. Investors should consider market conditions, the company’s growth strategy, and their risk tolerance before investing in TWLO stock.

FAQs

1. What is TWLO stock? TWLO stock refers to the publicly traded shares of Twilio Inc., a leading cloud communications platform.

2. How has TWLO stock performed historically? Since its IPO in 2016, TWLO stock has shown impressive growth, driven by Twilio’s strong revenue performance and strategic initiatives.

3. What factors drive the growth of TWLO stock? Key growth drivers include Twilio’s innovative product offerings, strategic partnerships, and expanding market presence in the cloud communications sector.

4. What are the risks associated with investing in TWLO stock? Risks include market volatility, regulatory changes, and competitive pressures, which can impact TWLO stock performance.

5. What is the future outlook for TWLO stock? The future outlook for TWLO stock is positive, with analysts predicting continued revenue growth and market expansion for Twilio.