VTNR Stock: A Comprehensive Guide for Investors

Introduction

Investing in the stock market can be daunting, but understanding the key components of a potential investment can make the process smoother. VTNR stock, representing Vertex Energy Inc., has been garnering attention in the investment community. This guide aims to provide a thorough analysis of VTNR stock, helping investors make informed decisions.

Company Background

Vertex Energy Inc. is a leading environmental services company focused on recycling industrial waste streams and converting them into valuable products. Understanding the company’s operations and market position is crucial for evaluating the potential of VTNR stock. The company’s commitment to sustainability and innovation plays a significant role in its stock performance.

Historical Performance of VTNR Stock

Analyzing the historical performance of VTNR stock can provide insights into its volatility and growth patterns. Over the past few years, VTNR stock has experienced significant fluctuations, influenced by market conditions and company developments. Reviewing past trends can help predict future movements and make informed investment choices.

Financial Health of Vertex Energy Inc.

The financial health of a company is a key indicator of its stock’s potential. VTNR stock’s performance is closely tied to Vertex Energy’s financial stability, including its revenue, profit margins, and debt levels. Evaluating financial statements and recent earnings reports can provide a clearer picture of VTNR stock’s prospects.

Market Position and Competitors

Vertex Energy operates in a competitive industry, with several players vying for market share. Understanding the company’s market position and its main competitors is essential for assessing the long-term viability of VTNR stock. Analyzing market trends and competitive advantages can offer valuable insights.

Recent Developments and News

Staying updated with recent developments and news related to VTNR stock is crucial for making timely investment decisions. This includes mergers, acquisitions, new product launches, and changes in regulations. Keeping an eye on news can help investors anticipate potential impacts on VTNR stock.

Analysts’ Ratings and Predictions

Financial analysts regularly evaluate stocks and provide ratings and predictions based on various factors. Reviewing analysts’ opinions on VTNR stock can offer a balanced view of its potential. Understanding the consensus and the reasons behind analysts’ ratings can aid in making informed investment choices.

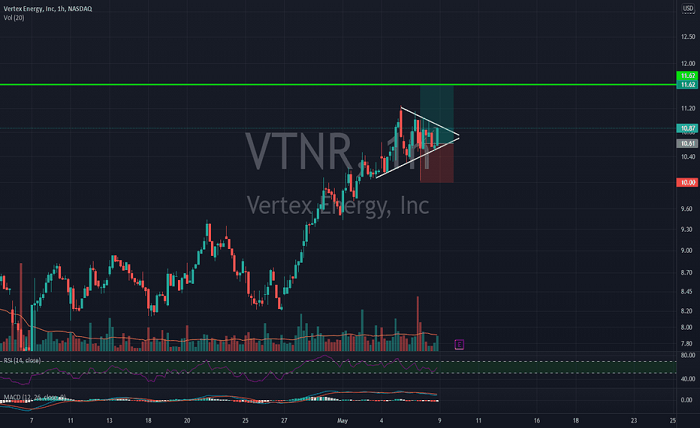

Technical Analysis of VTNR Stock

Technical analysis involves studying price charts and trading volumes to predict future price movements. For VTNR stock, this analysis can help identify patterns and trends that may not be evident through fundamental analysis alone. Using technical indicators, investors can refine their entry and exit strategies.

Risks and Opportunities

Every investment carries inherent risks and opportunities. VTNR stock is no exception. Identifying potential risks, such as market volatility or changes in environmental regulations, is essential. Conversely, recognizing opportunities, like expansion into new markets, can help balance the risk-reward ratio.

Dividend and Earnings Reports

Vertex Energy’s dividend policy and earnings reports significantly influence VTNR stock’s attractiveness to investors. Understanding the company’s approach to dividends and its earnings performance can help investors gauge the stock’s potential for income generation and growth.

Long-Term Investment Potential

Assessing VTNR stock’s long-term investment potential involves evaluating the company’s strategic plans, market trends, and industry outlook. For investors with a long-term horizon, understanding these factors is critical for making a sound investment decision.

Investment Strategies for VTNR Stock

Different investment strategies can be applied to VTNR stock, depending on individual goals and risk tolerance. Whether it’s a short-term trade based on technical analysis or a long-term hold based on fundamental strength, having a clear strategy is crucial for success.

How to Buy VTNR Stock

For those new to investing, understanding how to buy VTNR stock is essential. This includes choosing a brokerage, understanding the trading process, and staying informed about transaction fees. A step-by-step guide can make the buying process straightforward and accessible.

Conclusion

VTNR stock offers a unique investment opportunity within the environmental services sector. By understanding Vertex Energy’s business model, financial health, market position, and potential risks and opportunities, investors can make informed decisions. Whether you’re a seasoned investor or a beginner, thorough research and strategic planning are key to maximizing returns with VTNR stock.

FAQs

1. What does VTNR stock represent?

VTNR stock represents shares of Vertex Energy Inc., a company focused on recycling industrial waste and converting it into valuable products.

2. How has VTNR stock performed historically?

VTNR stock has experienced significant fluctuations, influenced by market conditions and company developments. Analyzing past trends can provide insights into its volatility and growth patterns.

3. What factors influence VTNR stock’s price?

VTNR stock’s price is influenced by Vertex Energy’s financial health, market position, recent developments, and broader market trends.

4. Is VTNR stock a good long-term investment?

Assessing VTNR stock’s long-term potential involves evaluating Vertex Energy’s strategic plans, industry outlook, and market trends. Investors should consider these factors before making a long-term investment.

5. How can I buy VTNR stock?

To buy VTNR stock, you need to choose a brokerage, understand the trading process, and be aware of transaction fees. A step-by-step guide can help simplify the process.