Investing in NASDAQ: RIVN – A Comprehensive Guide

Introduction

Investing in the stock market can be a rewarding venture, especially when you identify high-potential stocks. One such stock that has been attracting significant attention is NASDAQ: RIVN. Rivian Automotive, Inc., trading under the ticker RIVN, has made waves in the electric vehicle (EV) market. This blog post delves into various aspects of NASDAQ: RIVN, offering a detailed analysis for potential investors.

Overview of Rivian Automotive, Inc.

Rivian Automotive, Inc. is an American electric vehicle manufacturer and automotive technology company. Founded in 2009 by RJ Scaringe, Rivian focuses on producing sustainable, adventure-oriented electric vehicles. NASDAQ: RIVN symbolizes the company’s presence in the stock market, attracting investors interested in the EV industry.

Historical Performance of NASDAQ: RIVN

Understanding the historical performance of NASDAQ: RIVN is crucial for investors. Since its IPO in November 2021, Rivian has experienced significant volatility. Initial enthusiasm saw the stock price surge, but subsequent market corrections have presented both challenges and opportunities for investors.

Rivian’s Product Lineup

Rivian’s product lineup is central to its market identity and NASDAQ: RIVN’s appeal. The company currently offers the R1T, an electric pickup truck, and the R1S, an electric SUV. Both vehicles are designed for off-road capabilities, targeting adventure enthusiasts and environmentally conscious consumers.

Market Potential for Electric Vehicles

The market potential for electric vehicles (EVs) is immense, and NASDAQ: RIVN stands to benefit from this growth. As governments worldwide push for greener alternatives to traditional vehicles, companies like Rivian are positioned to capitalize on the shift towards electric mobility.

Rivian’s Competitive Landscape

Rivian operates in a highly competitive market. Analyzing NASDAQ: RIVN requires understanding its competitors, including industry giants like Tesla, Ford, and General Motors, all of which have significant investments in the EV sector. Rivian’s unique focus on adventure vehicles sets it apart in this crowded space.

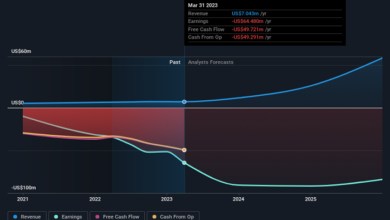

Financial Performance and Metrics

A deep dive into Rivian’s financial performance is essential for evaluating NASDAQ: RIVN. Key financial metrics include revenue growth, profitability, and cash flow. While Rivian is still in its growth phase, understanding its financial health provides insights into its long-term viability.

Rivian’s Production Capabilities

Rivian’s production capabilities directly impact NASDAQ: RIVN. The company has invested heavily in its manufacturing facilities, including a plant in Normal, Illinois. Scaling production to meet demand is critical for Rivian’s success and investor confidence in NASDAQ: RIVN.

Technological Innovations

Technological innovation is a cornerstone of Rivian’s strategy and a significant factor for NASDAQ: RIVN. Rivian’s vehicles feature advanced battery technology, autonomous driving capabilities, and a focus on software integration. These innovations help differentiate Rivian from its competitors.

Strategic Partnerships

Rivian has formed strategic partnerships that bolster NASDAQ: RIVN’s prospects. Notable collaborations include agreements with Amazon for electric delivery vans and with Ford for potential future projects. These partnerships provide financial support and market credibility.

Environmental, Social, and Governance (ESG) Factors

Investors increasingly consider Environmental, Social, and Governance (ESG) factors when evaluating stocks like NASDAQ: RIVN. Rivian’s commitment to sustainability and its role in reducing carbon emissions align with ESG criteria, making it an attractive option for socially conscious investors.

Analyst Ratings and Projections

Analyst ratings and projections play a vital role in shaping investor sentiment towards NASDAQ: RIVN. Many analysts have provided favorable ratings, citing Rivian’s growth potential and market positioning. However, as with any stock, there are also cautionary notes regarding market competition and production scalability.

Rivian’s Impact on the Automotive Industry

Rivian’s emergence has significantly impacted the automotive industry, influencing market dynamics and competitive strategies. NASDAQ: RIVN reflects this impact, as Rivian’s innovative approach challenges traditional automotive manufacturers to adapt to the evolving EV landscape.

Challenges Facing Rivian

Investing in NASDAQ: RIVN also means acknowledging the challenges facing Rivian. These include production bottlenecks, supply chain disruptions, and the need to achieve consistent profitability. Understanding these challenges helps investors make informed decisions.

Future Growth Prospects

The future growth prospects of NASDAQ: RIVN are tied to Rivian’s ability to expand its product lineup, enter new markets, and scale production. Rivian’s plans to introduce additional models and expand its global footprint are critical to its growth strategy.

How to Invest in NASDAQ: RIVN

For those interested in investing in NASDAQ: RIVN, understanding the investment process is essential. This includes choosing a brokerage, analyzing market trends, and determining the appropriate investment strategy based on individual financial goals and risk tolerance.

Conclusion

NASDAQ: RIVN represents a dynamic opportunity within the EV market. Rivian’s innovative products, strategic partnerships, and commitment to sustainability make it a compelling option for investors. However, like any investment, it comes with risks and challenges. By thoroughly understanding NASDAQ: RIVN and staying informed about market developments, investors can make more informed decisions.

FAQs

1. What is NASDAQ: RIVN?

NASDAQ: RIVN is the ticker symbol for Rivian Automotive, Inc., an American electric vehicle manufacturer that focuses on adventure-oriented electric vehicles.

2. How has NASDAQ: RIVN performed historically?

Since its IPO in November 2021, NASDAQ: RIVN has experienced significant volatility, with initial surges followed by market corrections.

3. What makes Rivian’s vehicles unique?

Rivian’s vehicles, including the R1T pickup truck and R1S SUV, are designed for off-road capabilities and adventure, setting them apart from other electric vehicles.

4. What are the main challenges facing NASDAQ: RIVN?

Challenges include production scalability, supply chain disruptions, and achieving consistent profitability, which are critical for Rivian’s long-term success.

5. How can I invest in NASDAQ: RIVN?

Investing in NASDAQ: RIVN involves choosing a brokerage, staying informed about market trends, and developing an investment strategy that aligns with your financial goals and risk tolerance.