Laying the Financial Foundation Early: A Guide to Preparing for Higher Education Costs

Introduction

The journey to higher education is an exciting time for students and families, but it can also bring financial stress. Starting preparations as early as 9th grade or even earlier can ease the burden of college expenses. This blog post outlines strategies to financially prepare for higher education, ensuring that when the time comes, you’re ready to invest in your future without unnecessary strain.

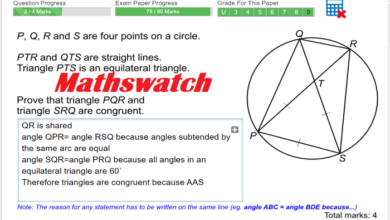

Understanding the Costs of Higher Education

Before diving into savings plans, it’s crucial to understand the potential costs of higher education. Tuition, books, housing, and additional fees can add up quickly. Researching these expenses early gives you a clear savings target.

Starting a Savings Plan

One of the most straightforward steps is to start a savings plan. Options like 529 plans offer tax advantages and can be started when a child is born, allowing for significant growth over time.

Exploring Scholarships and Grants

Scholarships and grants provide funds for education that don’t need to be repaid. Begin researching opportunities early, as some programs cater specifically to younger students.

Encouraging Academic Excellence

Good grades and high test scores can lead to academic scholarships. Encourage a strong academic foundation in 9th grade to maximize scholarship opportunities later on.

Considering Work-Study Programs

Work-study programs allow students to work part-time while attending school, providing a way to earn money and gain valuable experience. High school students can prepare by developing strong work habits and time management skills.

Learning Financial Literacy

Understanding personal finance is essential. Teach your child budgeting, saving, and the basics of credit to build a solid financial literacy foundation.

Utilizing Prepaid Tuition Plans

Prepaid tuition plans allow families to pay for future education at today’s prices. Investigating these plans early can lock in lower rates and avoid future tuition inflation.

Conclusion

Preparing for higher education costs is a marathon, not a sprint. By starting early, researching options, and encouraging financial literacy and academic excellence, families can create a robust plan that makes higher education financially attainable.

FAQs

- When should I start saving for higher education? The earlier, the better. Starting in 9th grade or earlier allows more time for savings to grow.

- What are 529 plans? 529 plans are tax-advantaged savings plans designed to encourage saving for future education costs.

- How can academic performance affect college costs? Strong academic records can lead to scholarships, reducing the need for loans.

- What is a work-study program? Work-study programs offer students part-time employment to help pay for education expenses.

- Why is financial literacy important? Understanding personal finance helps students manage their money effectively and make informed decisions about paying for college.