ORGN Stock: A Comprehensive Guide to Investing and Analysis

Introduction

ORGN stock has become a focal point for many investors looking to diversify their portfolios. With its unique position in the market and potential for growth, understanding the ins and outs of ORGN stock can be crucial for both new and seasoned investors. This guide will explore various aspects of ORGN stock, from its historical performance to advanced investment strategies.

What is ORGN Stock?

ORGN stock refers to the shares of Origin Materials, a company specializing in sustainable materials technology. Investing in ORGN stock means buying a piece of a company committed to revolutionizing the production of environmentally friendly materials.

Historical Performance of ORGN Stock

Analyzing the historical performance of ORGN stock provides insights into its market behavior over time. This includes examining past price trends, significant fluctuations, and the factors that influenced these changes. Understanding the history of ORGN stock can help predict future movements.

Factors Influencing ORGN Stock Price

Several factors impact the price of ORGN stock, including market demand, company performance, industry trends, and macroeconomic conditions. Investors must consider these variables to make informed decisions about buying or selling ORGN stock.

Market Position of Origin Materials

The market position of Origin Materials plays a critical role in the valuation of ORGN stock. As a leader in sustainable materials technology, the company’s innovations and strategic partnerships can significantly influence ORGN stock’s performance.

Financial Health of Origin Materials

Assessing the financial health of Origin Materials is crucial for evaluating the potential of ORGN stock. Key indicators include revenue growth, profit margins, debt levels, and cash flow. A financially stable company often translates to a more attractive ORGN stock.

Analyzing ORGN Stock with Fundamental Analysis

Fundamental analysis of ORGN stock involves evaluating the company’s financial statements, management quality, competitive advantages, and market conditions. This method helps determine the intrinsic value of ORGN stock and whether it is currently overvalued or undervalued.

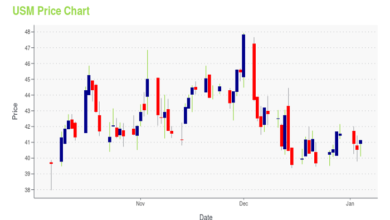

Technical Analysis of ORGN Stock

Technical analysis focuses on historical price and volume data to forecast future movements of ORGN stock. Using charts and technical indicators, investors can identify patterns and trends that may indicate potential buying or selling opportunities.

ORGN Stock in the Context of ESG Investing

Environmental, Social, and Governance (ESG) criteria are increasingly important for investors. ORGN stock, representing a company committed to sustainability, aligns well with ESG investing principles. Understanding how ORGN stock fits into this framework can attract socially conscious investors.

Comparing ORGN Stock with Competitors

Comparing ORGN stock with competitors helps investors understand its market standing and growth potential. Evaluating competitors’ stock performance, market share, and innovation can provide a broader perspective on the value of ORGN stock.

Investment Strategies for ORGN Stock

Various investment strategies can be applied to ORGN stock, including long-term holding, short-term trading, and dividend reinvestment. Each strategy has its advantages and risks, and investors should choose based on their financial goals and risk tolerance.

Risk Factors Associated with ORGN Stock

Investing in ORGN stock involves certain risks, such as market volatility, industry competition, and regulatory changes. Identifying and understanding these risks can help investors develop strategies to mitigate potential losses.

The Impact of Global Events on ORGN Stock

Global events, including economic crises, pandemics, and geopolitical tensions, can significantly affect ORGN stock. Investors must stay informed about global developments and their potential impact on ORGN stock to make timely investment decisions.

Long-term Growth Potential of ORGN Stock

The long-term growth potential of ORGN stock depends on the company’s ability to innovate and expand its market presence. Analyzing the company’s strategic plans, research and development efforts, and market trends can provide insights into the future prospects of ORGN stock.

Dividend Policies and ORGN Stock

Dividend policies are an essential consideration for investors looking at ORGN stock. Understanding the company’s dividend history and future payout potential can help investors make decisions aligned with their income objectives.

How to Buy ORGN Stock

For those interested in buying ORGN stock, the process involves choosing a brokerage, understanding trading fees, and setting up a trading account. A step-by-step guide to purchasing ORGN stock can make the process smoother for new investors.

Conclusion

Investing in ORGN stock offers a unique opportunity to be part of a company at the forefront of sustainable materials technology. By understanding the various aspects of ORGN stock, from its historical performance to future growth potential, investors can make informed decisions. Always consider the risks and stay updated with market trends to maximize your investment in ORGN stock.

FAQs

1. What is ORGN stock? ORGN stock represents shares of Origin Materials, a company focused on creating sustainable materials through innovative technology.

2. How can I analyze ORGN stock? Analyzing ORGN stock involves both fundamental and technical analysis, including evaluating financial statements and historical price patterns.

3. Is ORGN stock a good long-term investment? The long-term potential of ORGN stock depends on the company’s ability to sustain innovation and market growth. Evaluating strategic plans and market trends can provide insights.

4. What are the risks of investing in ORGN stock? Risks include market volatility, competition, regulatory changes, and global economic events. Understanding these risks can help in making informed investment decisions.

5. How do I buy ORGN stock? To buy ORGN stock, choose a brokerage, set up a trading account, understand the fees involved, and follow the brokerage’s process to purchase the stock.