ServiceNow Stock: A Comprehensive Guide

Introduction

ServiceNow, a leading entity in the cloud computing sector, has been a subject of interest for many investors. Tracking the performance of ServiceNow stock provides insights not only into the company’s financial health but also into broader tech industry trends. In this post, we will explore various facets of ServiceNow’s market presence and what they mean for investors.

ServiceNow’s Business Model

ServiceNow has carved a niche in providing cloud-based services that automate workflow and integrate business processes. The company’s products, centered around making work flow more efficiently, cater to a wide range of industries. This diversification is a significant factor in the stability of ServiceNow stock, ensuring its resilience in varying economic climates.

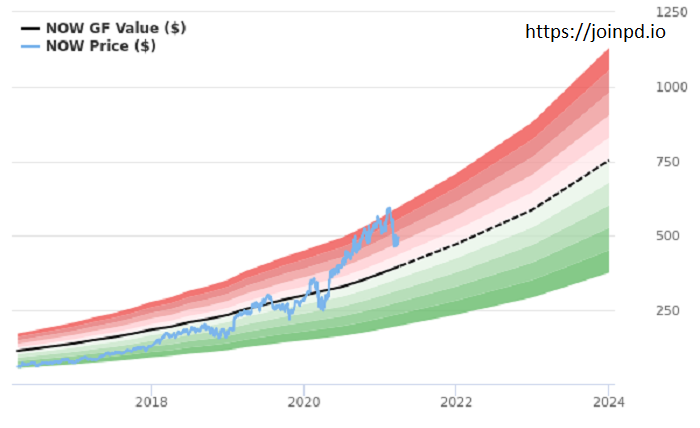

Historical Performance Analysis

A look back at the historical performance of ServiceNow stock reveals a pattern of growth that has attracted many to invest. We will delve into the stock’s performance over the past decade, understanding the peaks and troughs that characterize its journey on the stock market.

Recent Earnings Reports

Recent earnings reports are critical to gauging the current health of ServiceNow stock. We’ll analyze the latest quarterly results to understand how the company has fared amid economic shifts, including the impact of global events on its revenue and profit margins.

ServiceNow’s Market Position

Understanding ServiceNow’s position relative to its competitors is crucial. We’ll compare market shares, growth rates, and innovation metrics to see how ServiceNow stock stands against giants like Oracle and Microsoft in the cloud domain.

Analyst Ratings and Predictions

What do the experts say about ServiceNow stock? This section will cover analyst ratings and future stock price predictions, providing a rounded view of how market experts perceive the stock’s potential.

Investment Risks and Opportunities

Investing in ServiceNow stock comes with its set of risks and opportunities. We’ll discuss the volatility factors, potential market disruptors, and growth opportunities that could influence the stock’s performance.

Impact of Technological Innovations

ServiceNow has been at the forefront of technological innovation in cloud services. We’ll examine how their commitment to innovation influences the performance and perception of ServiceNow stock in the market.

ServiceNow’s Sustainability Initiatives

In today’s market, sustainability measures are increasingly influential. This section discusses ServiceNow’s initiatives in sustainability and their impact on investor interest and stock performance.

Dividend and Stock Buyback Programs

Does ServiceNow reward its shareholders with dividends or stock buybacks? Here, we’ll explore the company’s policies on shareholder returns and how they affect the attractiveness of ServiceNow stock.

Comparing ServiceNow with Other Tech Stocks

A comparative analysis with other tech stocks will help investors understand ServiceNow’s position in the industry. This comparison will focus on financial health, stock performance, and market valuation.

Conclusion

ServiceNow stock represents a dynamic investment opportunity within the tech sector. With its robust business model, commitment to innovation, and strategic market positioning, ServiceNow is well-equipped to navigate the challenges and capitalize on opportunities in the evolving market landscape. Investors should keep an eye on the factors discussed to make informed decisions about ServiceNow stock.

FAQs

Q1: Why is ServiceNow considered a good investment?

ServiceNow’s broad portfolio of cloud-based solutions and consistent growth in revenue make it a compelling investment, especially for those looking to diversify into the tech sector.

Q2: What risks should investors be aware of when investing in ServiceNow stock?

Investors should consider market competition, technological disruptions, and economic downturns as potential risks that could impact ServiceNow stock.

Q3: How does ServiceNow’s performance compare to its competitors?

ServiceNow frequently leads in innovation and customer satisfaction, which often translates to better stock performance compared to some traditional competitors.

Q4: What impact do ServiceNow’s sustainability initiatives have on its stock?

Sustainability initiatives enhance ServiceNow’s corporate image and appeal to a growing segment of environmentally and socially conscious investors, potentially boosting its stock.

Q5: Can fluctuations in the tech market affect ServiceNow stock?

Yes, like any tech stock, ServiceNow is susceptible to broader tech market fluctuations, which can affect its stock price significantly.